The whispers had been circulating for months, fueled by leaks, rumors, and the usual pre-release hype. Now, the numbers are in, and they paint a compelling picture: the launch of the iPhone 16 was not just successful; it was a record-breaking phenomenon.

While Apple’s official fiscal Q4 (calendar Q3) earnings report hinted at a strong performance, new data from market analysts provides a much clearer understanding of just how significant this launch truly was. It wasn’t just about selling more phones; it was about selling them at a higher price, reflecting a shift in consumer behavior and Apple’s strategic approach.

Apple’s October earnings call revealed a new revenue record for the September quarter, a period traditionally crucial for the company due to the annual iPhone refresh. The company reported a substantial $94.93 billion in revenue, a 6% year-over-year increase compared to the $89.5 billion generated in the same quarter the previous year.

This announcement alone signaled a positive trend, but the details remained somewhat opaque. Apple, as is its custom, refrained from disclosing specific unit sales figures, leaving analysts and industry observers to speculate about the underlying drivers of this revenue surge.

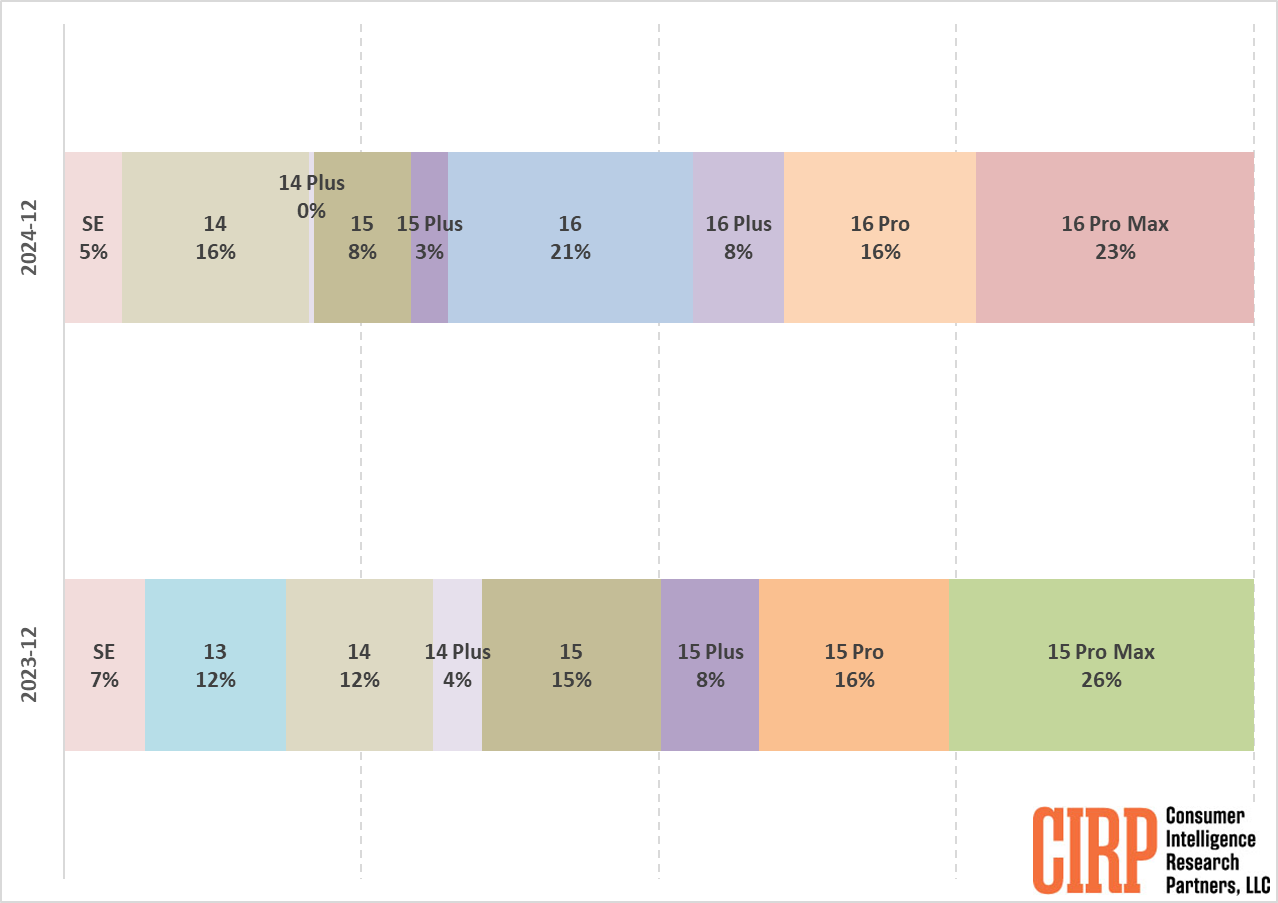

The key question was whether this growth stemmed from increased sales volume, a higher average selling price (ASP), or a combination of both. New insights from market research firms have now shed light on this crucial aspect. Data reveals that Apple’s revenue surge was fueled by both record-breaking iPhone shipments and the highest average selling price ever achieved for the iPhone lineup. This confirms that the iPhone 16 launch quarter was a resounding success on multiple fronts.

This data underscores an interesting dynamic in the smartphone market. While Apple has long ceased reporting individual unit sales, opting instead to focus on revenue figures, the market research provides a much-needed level of granularity.

The data confirms not only that Apple led in terms of revenue, but also that it achieved record shipments and the highest ASPs for a third quarter in the calendar year. This triple win is a testament to the enduring appeal of the iPhone brand and the effectiveness of Apple’s pricing strategy.

The broader context of the smartphone industry also plays a significant role in understanding Apple’s performance. Across the entire sector, an increase in ASP played a more prominent role in driving revenue growth than a surge in unit sales. Global smartphone shipments saw a modest 2% year-over-year increase in Q3 2024.

However, global smartphone revenues rose by a more substantial 10% year-over-year, driven largely by a 7% increase in the average selling price. This indicates a broader trend of consumers being willing to spend more on their smartphones, a trend that Apple has clearly capitalized on.

This analysis reveals a compelling narrative. The iPhone 16’s launch quarter was a triumph, driven by both increased sales volume and a higher average selling price. While the overall smartphone market experienced modest growth in shipments, the significant increase in ASP across the industry highlights a shift in consumer spending habits.

Apple’s ability to achieve record shipments alongside record ASPs demonstrates the strength of its brand, the desirability of its products, and the effectiveness of its market positioning. This combination of factors solidified Apple’s position as a dominant force in the global smartphone arena.

This also indicates an interesting shift in consumer buying behavior. People are willing to invest more in their smartphones, which have become essential tools in modern life. Apple has successfully positioned itself to take advantage of this trend, offering premium products at premium prices that consumers are willing to pay.

Source